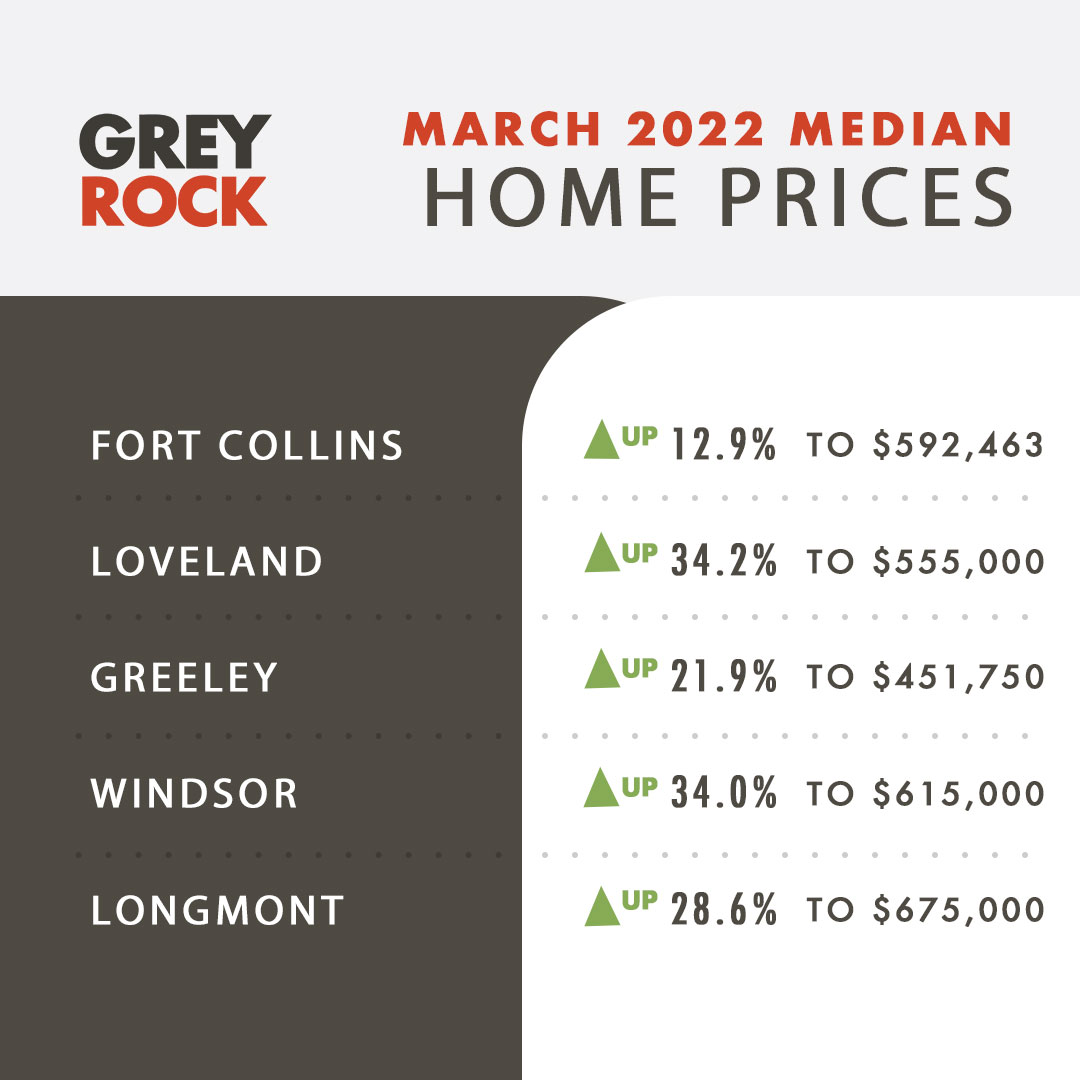

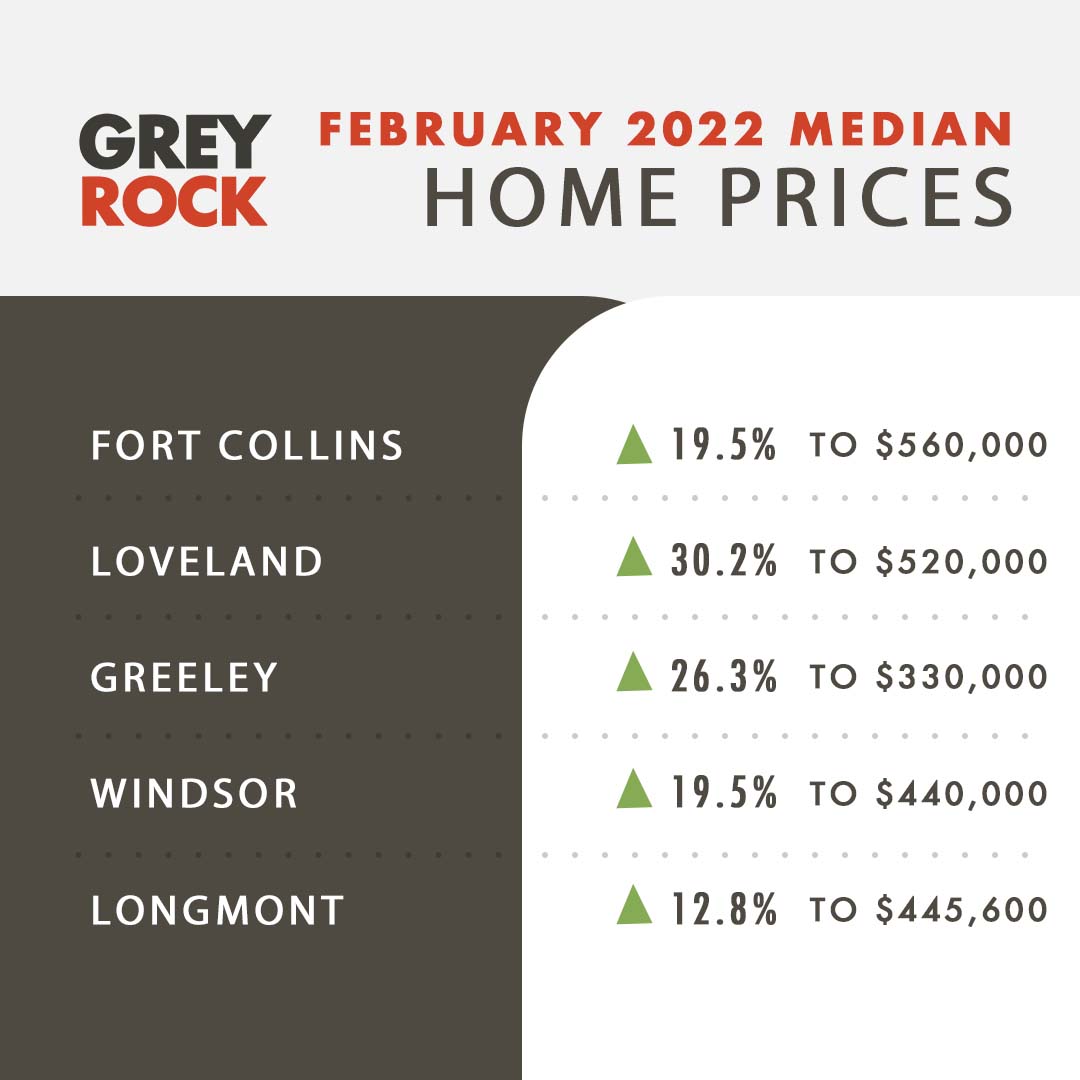

The big news this month has been how fast mortgage interest rates have climbed. We are near 5% for a 30 year fixed. Depending on their financing and price point, this has increased the cost of ownership for a typical buyer in NoCo by about $500-$1,000 per month. Obviously this is a huge increase and everyone is bracing for the impact this will have on the housing market. But so far, we have been shocked at how un-noticeable the impact has been. Over the last month, neither myself or anyone on our team of 12 full time realtors, have reported any perceivable change in the market despite having put buyers into homes at these higher rates for weeks now. Our colleagues across the city seem to agree: There seems to be no noticeable effect on the level of competion for each listing, the number of offers each listing receives, or how high folks are paying over the list price. Despite massive increases in the cost of borrowing, it feels like the same wildly competitive market that we’ve grown accustomed to over the last 5 years.

Wasn’t the market supposed to crash when interest rates rose?

Rates are now at 4.5%.

People are paying $625/month more for a $500k mortgage than they were a year ago.

So why aren’t homes taking longer to sell? Why aren’t prices coming down?

More people need homes in America than at any point in our history.

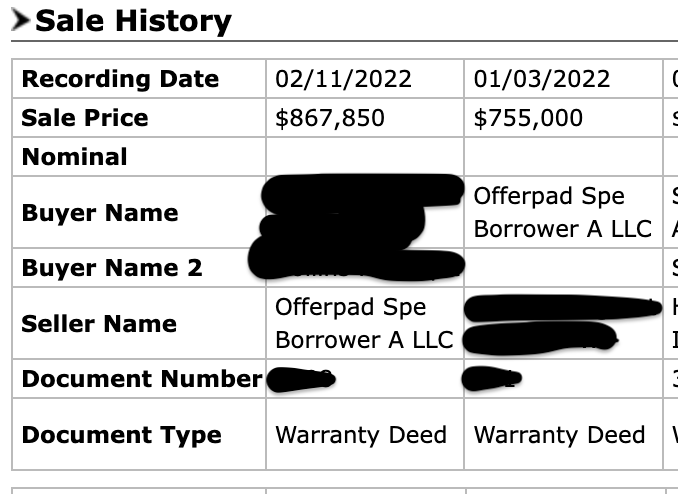

This person sold their home to an ibuyer, in this case Offerpad, for $755,000. It never went on the market.

Offerpad then put it on market a few weeks later and sold it for another $112,000 without putting a dime into it other than a professional cleaning.

This is something I hear my clients say frequently and you just can't push them in these situations. Maybe they'll get the house, maybe not. But you gotta go at their pace and make sure they have time to test the waters and see what happens when they make an offer. That often means writing three or four unsuccessfully but every so often we get lucky and it's one and done. I'm feeling lucky today.

With the market moving so fast, when looking at comparable sales, the time that has elapsed since a home sold has become a huge factor that should be accounted for.

How much are mortgage closing costs? A good rule of thumb is 1.25%-1.5% of the loan amount.

But that’s not the whole story. You can reduce your closing costs by choosing a rate that’s higher than what today's rate “par” rate is and the lender will give you a credit that you can use to reduce your costs.

We have reached all-time lows in inventory despite significant mortgage rate increases. Rates are now bouncing around 3.6-3.9%. It’s important for buyers to note there is the same number of homes coming on the market each month as there were 10 years ago. They are just getting purchased more quickly by a pool of buyers that is larger than we have ever seen in history. This large buyer pool is simply a function of demographics: there are more people in the prime home-buying age bracket (late 20s to early 40s) than there has ever been. Interest rates add fuel to the fire. But demographics are the foundation of the persistent supply shortage.

| Newer Posts | Older Posts |